Things about Stonewell Bookkeeping

Wiki Article

Stonewell Bookkeeping - An Overview

Table of ContentsExcitement About Stonewell BookkeepingStonewell Bookkeeping - The FactsThe smart Trick of Stonewell Bookkeeping That Nobody is Talking AboutThe Ultimate Guide To Stonewell BookkeepingThe 3-Minute Rule for Stonewell Bookkeeping

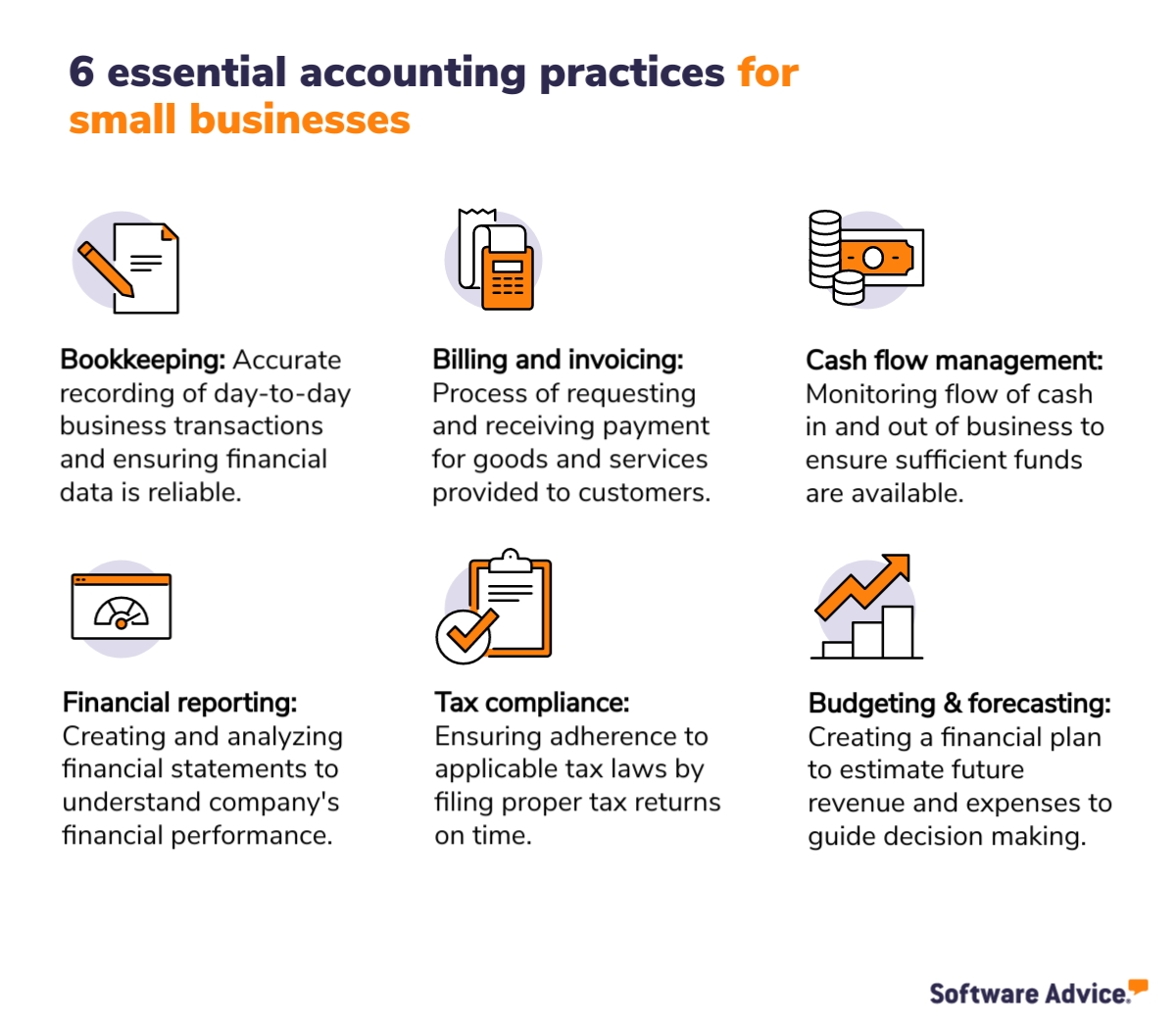

Below, we respond to the concern, exactly how does bookkeeping help a service? The real state of a company's financial resources and cash circulation is constantly in change. In a sense, audit books represent a snapshot in time, but just if they are updated often. If a business is taking in little, a proprietor must do something about it to boost earnings.-resize.jpg?token=0fac00d8975a85036711fd992adadc83)

None of these conclusions are made in a vacuum as factual numerical details need to copyright the economic decisions of every small company. Such data is put together through accounting.

Still, with correct cash circulation monitoring, when your publications and ledgers are up to date and integrated, there are far fewer question marks over which to fret. You understand the funds that are offered and where they fail. The information is not always great, however a minimum of you understand it.

The Facts About Stonewell Bookkeeping Uncovered

The puzzle of reductions, credit scores, exemptions, timetables, and, obviously, penalties, is adequate to just give up to the IRS, without a body of efficient documents to sustain your cases. This is why a devoted accountant is indispensable to a tiny organization and deserves his/her weight in gold.

Your service return makes cases and representations and the audit targets at verifying them (https://www.quora.com/profile/Stonewell-Bookkeeping). Great accounting is everything about linking the dots between those depictions and truth (Accounting). When auditors can comply with the information on a journal to invoices, bank statements, and pay stubs, among others files, they swiftly discover of the expertise and stability of business company

The 3-Minute Rule for Stonewell Bookkeeping

In the exact same method, haphazard bookkeeping contributes to tension and anxiousness, it likewise blinds local business owner's to the possible they can recognize over time. Without the info to see where you are, you are hard-pressed to set a location. Just with easy to understand, in-depth, and accurate data can an entrepreneur or management group story a program for future success.Company owner understand ideal whether a bookkeeper, accountant, or both, is the best option. Both make essential payments to a company, though they browse around this site are not the exact same profession. Whereas a bookkeeper can gather and organize the info needed to sustain tax preparation, an accountant is much better suited to prepare the return itself and really analyze the income statement.

This write-up will certainly look into the, consisting of the and how it can benefit your service. We'll additionally cover exactly how to get going with accounting for a sound financial footing. Bookkeeping involves recording and organizing financial transactions, including sales, purchases, settlements, and invoices. It is the procedure of keeping clear and succinct records so that all economic information is easily accessible when required.

This write-up will certainly look into the, consisting of the and how it can benefit your service. We'll additionally cover exactly how to get going with accounting for a sound financial footing. Bookkeeping involves recording and organizing financial transactions, including sales, purchases, settlements, and invoices. It is the procedure of keeping clear and succinct records so that all economic information is easily accessible when required.By frequently upgrading economic records, accounting assists companies. Having all the monetary details quickly obtainable maintains the tax authorities completely satisfied and avoids any kind of last-minute migraine throughout tax obligation filings. Regular bookkeeping makes certain well-kept and organized records - https://swaay.com/u/stonewellbookkeeping77002/about/. This helps in conveniently r and conserves companies from the stress of looking for files during deadlines (business tax filing services).

The Best Guide To Stonewell Bookkeeping

They also desire to understand what possibility the company has. These aspects can be easily managed with accounting.Therefore, bookkeeping assists to stay clear of the problems related to reporting to financiers. By maintaining a close eye on economic records, services can establish reasonable goals and track their development. This, in turn, fosters far better decision-making and faster organization growth. Government regulations often need services to maintain economic records. Normal bookkeeping ensures that organizations stay certified and prevent any type of fines or legal concerns.

Single-entry bookkeeping is simple and works ideal for little businesses with few deals. It does not track assets and responsibilities, making it much less extensive contrasted to double-entry accounting.

The Of Stonewell Bookkeeping

This could be daily, weekly, or monthly, depending on your service's size and the quantity of deals. Don't be reluctant to look for assistance from an accounting professional or bookkeeper if you discover managing your economic documents testing. If you are seeking a complimentary walkthrough with the Bookkeeping Remedy by KPI, contact us today.Report this wiki page